What is a Credit Score?

A credit score is a number based on a mathematical formula that predicts your creditworthiness. Scores range from 300 to 850—the higher your score, the more likely you are to qualify for a loan with favorable terms.

Higher Scores: Easier approval for loans and lower interest rates.

Lower Scores: May still qualify for credit, but at higher interest rates.

Having a high credit score can save you thousands of dollars over the life of loans, including mortgages, auto loans, and credit cards. If your credit score is low, improving it can make a huge difference in reducing your overall interest costs.

Higher Scores: Easier approval for loans and lower interest rates.

Lower Scores: May still qualify for credit, but at higher interest rates.

Having a high credit score can save you thousands of dollars over the life of loans, including mortgages, auto loans, and credit cards. If your credit score is low, improving it can make a huge difference in reducing your overall interest costs.

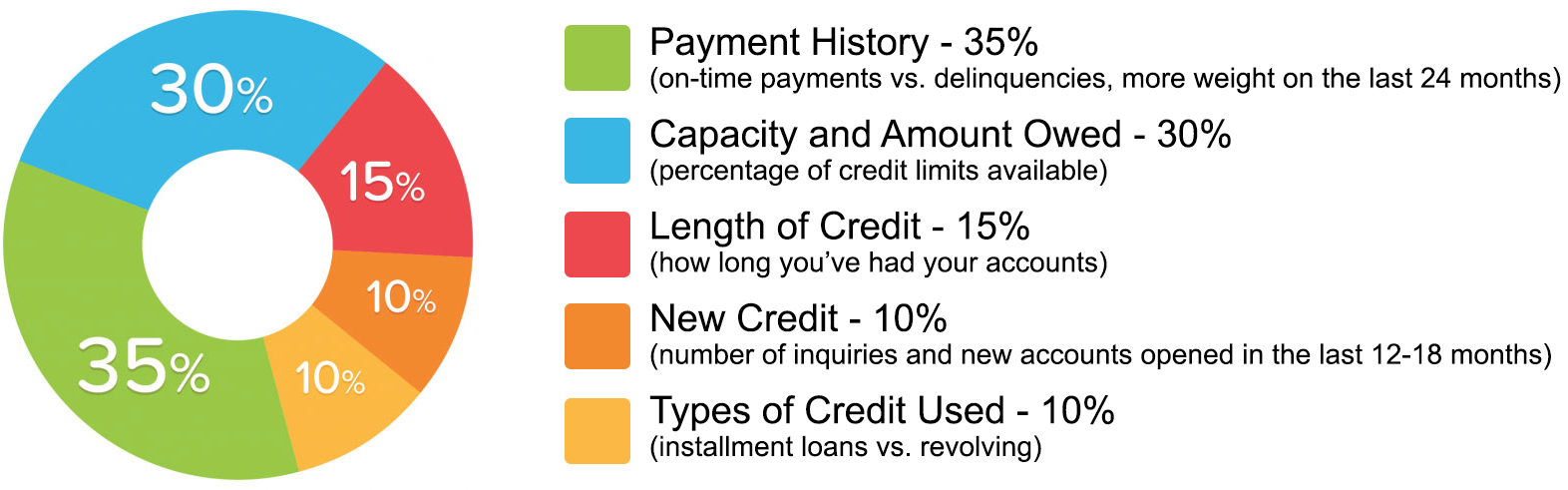

What affects your Credit Score?

How We Can Help

We assist in the credit repair process by challenging negative items on your credit reports through legal means and working to ensure that your credit file is accurate and compliant with the law.

- Maximizing Debt-to-Income Ratio: Even if paying off your credit cards isn't an immediate option, we can guide you on how to improve your debt-to-income ratio, a key factor in improving your credit score.

- Credit Inquiries: While we cannot guarantee the removal of all negative items, we can help identify inaccuracies in credit inquiries and dispute them when applicable.

Common Credit Report Issues

Many people don’t realize that their credit reports may contain errors. In fact, studies show that nearly 80% of all credit reports contain serious errors, and many of these inaccuracies could be affecting your credit score.

- Credit Bureaus: There are three main credit bureaus--Equifax, Experian, and TransUnion. Each one may report different information, and discrepancies may cause score variations of up to 60 points between bureaus.

- Errors on Credit Reports: Some errors could be incorrect reporting, incomplete information, or outdated data. These need to be addressed to ensure that your credit report reflects your true financial history.

How Long Will Certain Items Stay on My Credit Report?

- Delinquencies (30-180 days): Stay for 7 years from the date of the missed payment.

- Collection Accounts: Stay for 7 years from the date of the original missed payment. When paid, marked as a “paid collection.”

- Charge-Off Accounts: Stay for 7 years from the date of the original missed payment.

- Closed Accounts: Stay for 7 years for delinquent accounts. Positive accounts stay for 10 years.

- Bankruptcy:

- Chapter 7, 11, or 12: 10 years

- Chapter 13: 7 years

- Chapter 7, 11, or 12: 10 years

- Tax Liens:

- Unpaid: 15 years

- Paid: 10 years

- Unpaid: 15 years

- Credit Inquiries: Typically remain for 2 years, with some exceptions for pre-approved offers and employment inquiries.

How to Improve Your Credit Score

- While working with Credit Envy, here are additional steps you can take to boost your credit score:

- Pay Your Bills On Time: Timely payments for utilities, mortgages, auto loans, and credit cards help build a solid payment history.

- Check Your Credit Report Regularly: Review your credit reports at least once a year. Challenge inaccurate or outdated information.

- Keep Credit Card Balances Below 30%: Maintain a low balance relative to your credit limit. Pay down high balances to keep your credit utilization ratio under control.

- Use Credit Responsibly: Avoid the common mistake of never using credit again to “fix” your score. Use credit for small, manageable purchases and pay off the balance in full each month.

- Keep Accounts Open: The longer your accounts are active, the better for your credit score. Avoid closing old accounts unless necessary.

Important: Credit Repair Takes Time

Improving your credit score is a long-term commitment. While it’s possible to see improvements in your credit report, these changes won’t happen overnight. Stay patient and continue practicing good financial habits—these will help you maintain a strong score long after the repair process is complete.

Refund & Cancellation Policy

As per the Credit Repair Organizations Act (CROA), if we do not remove at least 25% of the negative items on your credit report within a specified period, you are entitled to a full refund. This policy ensures that we are committed to providing real, measurable results.

What Information Can’t Be On Your Credit Report?

There are certain types of information that cannot appear on your credit report, including:

- Medical information (without your consent)

- Bankruptcy notices older than 10 years (Chapter 11)

- Debts older than 7 years (including delinquent child support)

- Personal details like age, marital status, or race (unless specifically requested by an employer)